The Macau Anti-Money Laundering Specialists Association hosting the "2023 Anti-Money Laundering/Anti-Financial Crime Annual Conference"

The “2023 Anti-Money Laundering/Anti-Financial Crime Annual Conference”, hosted by the Macau Anti-Money Laundering Specialists Association (MAMLSA), was held on July 22 at the Hyatt Regency Hotel in Hengqin. The honourable guests attending included Mr. Vong Lap Fong, Executive Director of the Monetary Authority of Macao; Ms. Chu Un I, Connie, Director of the Financial Intelligence Office of Macao; Mr. Pao Wai Chon, Jay, Deputy Director of the Financial Development Bureau of Guangdong-Macao In-Depth Cooperation Zone in Hengqin; as well as President Mr. Chan Weng Tat, Chairman Ms. So Kwok Wah, Chief Supervisor Mr. Lam Cheng Kong, and Legal Advisor Ms. Fung Oi Lam of the MAMLSA. The annual conference attracted more than 260 professionals from banking, insurance, and government departments from Hong Kong SAR, Macao SAR and the Mainland China. The organizer hopes to gather skills from all industry sectors, to exchange and learn from one another’s valuable experience in anti-money laundering/anti-financial crimes, and to promote the practice and innovation in anti-money laundering work.

President Chan expressed in his opening speech that, in recent years, the association has actively acted as a platform, gathering skills from institutional and cross-border professionals, integrating local and global viewpoints, and keenly capturing the latest changes and trends in the industry, to comprehensively enhance the capabilities and standards for governing money laundering/financial crimes. Such effort has arisen public awareness and gained public recognition. With the announcement of the “Development Framework for Guangdong-Hong Kong-Macao Greater Bay Area “ and “30 Measures for Hengqin Financial Sector”, it needs a wider scope for governance to create a new model for monitoring money laundering/financial crimes in cross borders, cross currencies, and cross systems, from inside to outside. In addition, it is also necessary to make use of technological skills continuously, to effectively alert, identify and control money laundering risks so as to better deal with increasingly complex and globalized money laundering risks.

In his keynote speech, Executive Director Vong said that the AMCM pays close attention to the money laundering risks brought about by the changes in the financial market. It is now connecting with People’s Bank of China, Guangzhou Branch, to establish and implement a long-term reporting mechanism on money laundering risk across Guangdong and Macao to prevent illegal and criminal activities of cross-border money laundering. In terms of risk control in new areas of the financial sector, the AMCM is now actively studying international anti-money laundering requirements, and will incorporate the requirements into the scope of reference for drafting laws and guidelines when cultivating newly formed financial markets such as the bond market and wealth management. In addition, it also applies varied regulatory means to understand the latest risk situation and take appropriate control measures to ensure that financial institutions strictly follow anti-money laundering requirements for consistently enacting good governance work.

Director Chu revealed that the number of suspicious transactions in the first half of this year has increased by nearly 60% compared to the same period last year, and it is expected that the number of suspicious transactions in the whole year will return to the pre-epidemic level. The Financial Action Task Force (FATF) suggested several work revision proposals in this year’s annual conference and also paid special attention on the anti-money laundering risks brought about by the development and application of global virtual assets. The Financial Intelligence Office will closely discuss and analyse these FATF revisions through the anti-money laundering and anti-terrorist financing working group and authorized entities to examine the impact of relevant projects on the Macao SAR. In addition, private institutions are also encouraged to continuously develop and improve their internal control systems on anti-money laundering and anti-terrorist financing risk, train and improve compliance personnel, strengthen awareness of confidentiality obligations for suspicious transactions so that the Macao SAR can accurately respond to each international assessment requirement.

Six roundtable meetings were held at the annual conference, chaired and delivered by 18 scholars and business executives from anti-money laundering-related fields in Mainland China, Hong Kong SAR and Macao SAR. Also, with the technical support provided by ACAMS, they shared experience and discussed the future development of anti-money laundering on topics such as the new trends of anti-money laundering, risks and prevention of cross-border financial crimes in the Greater Bay Area and Guangdong-Macao In-Depth Cooperation Zone, legal connection mechanism across different legal systems, risk prevention and control on virtual assets, technological applications on financial crime identification, development of international sanctions and compliance. There were discussion sessions in between the meetings, inspiring the participants to have a more comprehensive and in-depth understanding about the work of anti-money laundering and anti-financial crime, and also allowing suggestions on anti-money laundering and anti-financial crime to unfold.

Chairman So concluded with the aim on carrying out this in-depth discussion on different anti-money laundering issues in this annual conference is to improve the ability of anti-money laundering work in the industry, in an attempt to promote the practice and innovation of anti-money laundering work, and with existing skills and new methods, to explore more efficient and precise anti-money laundering techniques and measures, in order to deliver positive contributions to the new ecology of anti-money laundering.

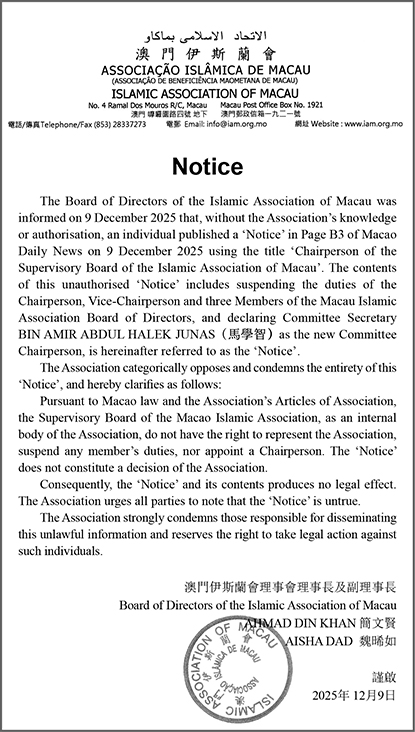

This photo provided by the Macau Anti-Money Laundering Specialists Association (MAMLSA) show the participants in the 2023 Anti-Money Laundering/Anti-Financial Crime Annual Conference posing for a group photo at the Hyatt Regency Hotel in Hengqin last Saturday: Fung Oi Lam (left), Legal Advisor of the MAMLSA; So Kwok Wah (second from left), Chairman of the MAMLSA; Connie Chu Un I, (third from left), Director of the Financial Intelligence Office of Macao; Chan Weng Tat (centre), President of the MAMLSA; Vong Lap Fong (third from right), Executive Director of the Monetary Authority of Macao (AMCM); Jay Pao Wai Chon (second from right), Deputy Director of the Financial Development Bureau of the Guangdong-Macao In-Depth Cooperation Zone in Hengqin; Lam Cheng Kong (right), Chief Supervisor of the MAMLSA.