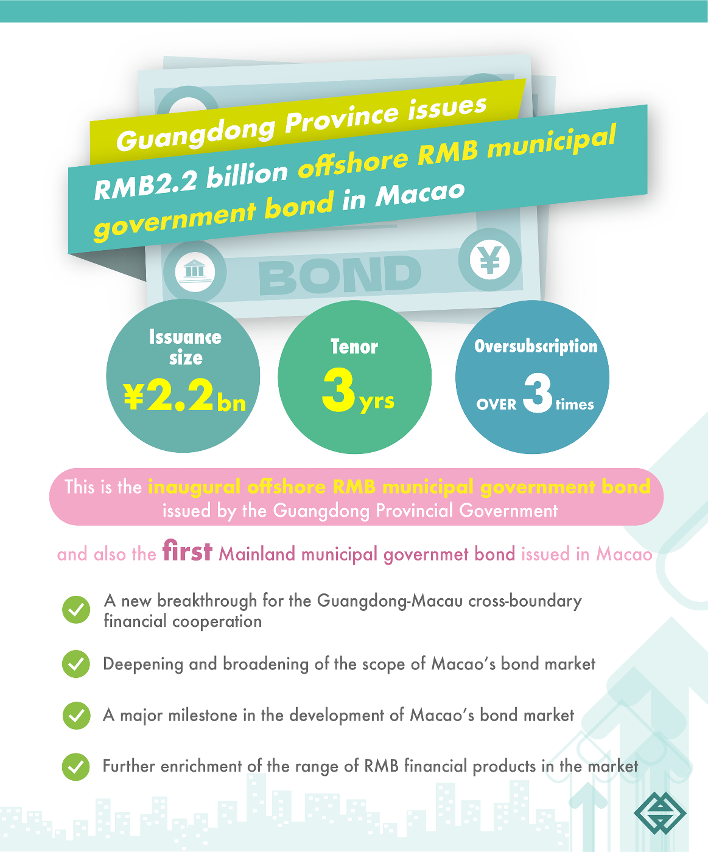

Guangdong province issued this week offshore municipal government bonds in Macau, marking the first mainland municipal government bonds have been issued in the special administrative region.

The bonds were offered on Tuesday to institutional investors with an issuance size of 2.2 billion yuan, a tenor of three years and an interest rate of 2.68 percent.

The Macau Special Administrative Region (MSAR) government said in a statement that the bonds are providing local and other institutional investors with more investment options, as well as opportunities to participate in the economic development of Guangdong.

Hailing the issuing as a new breakthrough for Guangdong-Macau cross-border financial cooperation, the MSAR government said the move will also deepen and broaden the scope of Macau's bond market, reinforce the stable development of the local bond market, promote the internationalization of the renminbi (yuan) and further enrich the range of renminbi financial products available in Macau's offshore market.

A bond is a fixed income instrument that represents a loan made by an investor to a borrower – typically corporate or governmental. According to Investopedia, a bond could be thought of as a promissory note between the lender and borrower that includes the details of the loan and its payments. Bonds are used by companies and governments to finance projects and operations. Owners of bonds are debtholders, or creditors ,of the issuer. Bond details include the end date when the principal of the loan is due to be paid to the bond owner and usually include the terms for variable or fixed interest payments made by the borrower.

- Xinhua, MPD