The Social Security Fund (FSS) announced in a statement yesterday that its electronic filing service has been optimised for the convenience of employers.

The electronic filing service enables employers to complete the filing and payment procedures “anytime, anywhere, without leaving their office” for their system’s local long-term employees and fixed-term labour contract employees (aka casual workers), the statement pointed out.

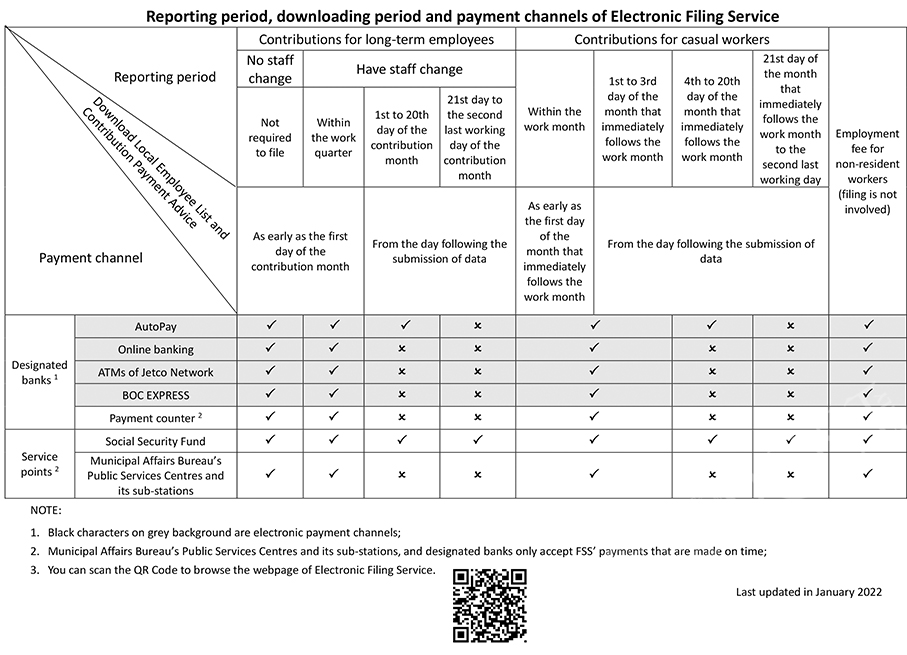

The statement noted that the optimisations include employers not being required to file when there is no change in the respective work quarter’s long-term employees, the system’s automatic generation of a “Contribution Payment Advice”, and enabling the employers to use the various electronic payment channels such as the designated banks’ AutoPay and online banking for contribution payments.

Upon a change in the employment situation, the reporting period will be adjusted from the entire work quarter to the contribution month’s second last working day, the statement added. Employers just need to report within the work quarter and may download the “Contribution Payment Advice” and the “Local Employee List” as early as the contribution month’s first day.

The statement underlined that the reporting period for casual workers’ contributions has also been extended from the work month to the second last working day of the following month. The “Contribution Payment Advice” and the “Local Employee List” can be downloaded on the following month’s first day if the filing is done within the work month.

The statement noted that employers who have completed the employer registration may fill in a “special form” and submit it with the required documents to an FSS service point.

Upon activation, employers can log in to the system using “My Government Account of Macao SAR” for purposes such as employee data submission, download of Contribution Payment Advice, as well as enabling employers to view the list of non-resident workers required to pay employment fees.

Further information can be found by visiting the webpage of Electronic Filing Service on the FSS’s website, or calling 2853 2850 during office hours.

This chart provided by the Social Security Fund (FSS) yesterday shows the reporting period, downloading period and payment channels of the electronic filing service.