Secretary for Economy and Finance Lei Wai Nong said yesterday that the Macau government would possibly issue government bonds in the future with the aim of promoting the development of the city’s bond market.

Lei made the remarks when replying to an oral interpellation by lawmaker-cum-banker Ip Sio Kai during a plenary session in the legislature’s hemicycle.

Ip suggested that the Macau government issue retail bonds, such as silver bonds and inflation-indexed bonds, in reference to Hong Kong, with the aim of boosting the development of Macau’s bond market as well as enabling the government to finance its public infrastructure projects with an extra channel.

Lei noted that the financial reserves of the Macau Special Administrative Region (MSAR) reached 566.6 billion patacas at the end of October last year, indicating that the local government’s public finances are in a sound and healthy condition.

Lei insisted that, merely for the purpose of supporting the public finances, there was currently no need to issue government bonds with the aim of “raising funds”.

However, the policy secretary was quick to add that the local government “would not rule out the possibility” of issuing government bonds in the future for the “non-pecuniary” purpose of promoting the sustainable development of Macau’s bond market in compliance with the government’s ongoing drive to develop the city’s modern finance industry.

The central government has issued renminbi-denominated sovereign bonds in Macau three times, while Guangdong has also issued offshore renminbi-denominated provincial government bonds in Macau three times. Renminbi (“people’s currency”) is the official name of the nation’s legal tender, informally known as “yuan”.

Lei also noted that Macau’s possible issuance of government bonds would require the enactment of new legislation. The policy secretary pledged that the Macau government would continue to promote the “healthy” development of the city’s bond market in an orderly manner, adding that for the time being the development of Macau’s bond market could be expected to still be primarily supported by the possible issuing of sovereign bonds and the mainland’s local government bonds.

Full employment

Meanwhile, Lei also pointed out during yesterday’s plenary session that Macau’s latest unemployment rate of local residents has dropped to 2.9 percent, adding that in many countries and regions this figure can be regarded as indicating “full employment”.

Full employment is a situation where there is no cyclical unemployment but structural unemployment and frictional unemployment may still exist.

Lei said that the city’s continuous decrease in local residents’ unemployment rate is not only the result of the Labour Affairs Bureau’s (DSAL) job-matching sessions but also, more importantly, the post-pandemic recovery of the city’s economy.

According to the latest official data, Macau’s general unemployment rate between September and November last year stood at 2.3 percent, while local residents’ unemployment rate was 2.9 percent. The general unemployment rate comprises residents and non-resident workers (NRWs).

During the period, the number of the unemployed stood at 8,600.

Lei said yesterday that currently around 1,000 of the unemployed in the city are jobseekers affected by frictional unemployment, which refers to the gap between someone voluntarily leaving a job and finding another.

Lei also said that unemployed local residents are generally not very willing to take up jobs of certain types such as waiters, cleaners and hotel-room attendants. Lei noted that since the city’s economy started to recover early last year after the three-year COVID-19 pandemic, many companies have found it quite difficult to hire enough NRWs because Macau is being affected by labour-recruitment competition from neighbouring countries and regions.

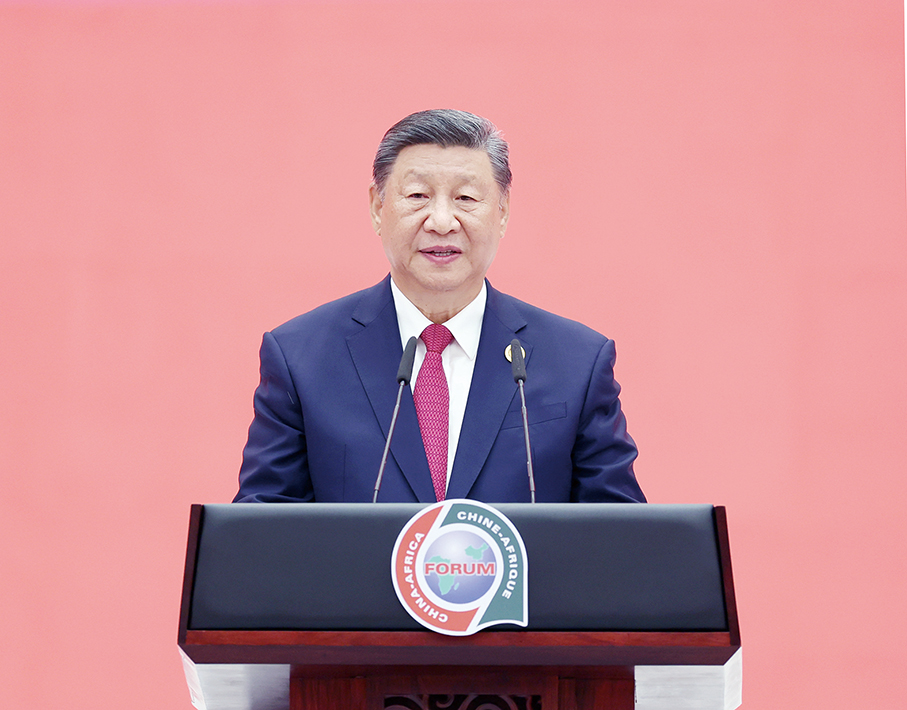

Secretary for Economy and Finance Lei Wai Nong speaks during yesterday’s plenary session in the Legislative Assembly’s (AL) hemicycle. – Photo courtesy of TDM