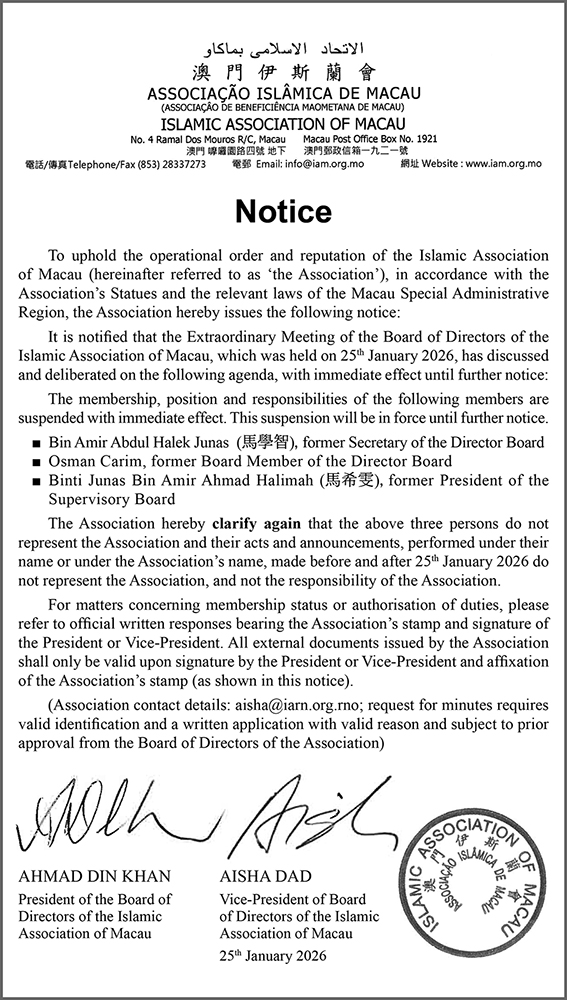

Davis Fong Ka Chio, who heads the Institute for the Study of Commercial Gaming at the University of Macau (UM), said yesterday he expected Macau’s gaming revenues to rise by up to 10 percent this year.

Fong made the remarks in an interview with The Macau Post Daily in his office on the UM campus in Hengqin.

Casino revenues fell 3.3 percent to 223.2 billion patacas last year, easing from the 34.3 percent drop recorded in 2015.

The final five months of last year recorded consecutive year-on-year increases in an industry recovery, with the revenues last month rising by eight percent year-on-year to 19.8 billion patacas.

The government expects the city’s gaming receipts this year to once again amount to about 200 billion patacas.

Fong said the fact that casino revenues rose for five consecutive months showed that the city’s gaming sector is recovering.

Fong said that the recent months’ figures showed that the sector had not and would not experience a V-shaped recovery, because the gaming revenues during the recovery period had not risen by 20 to 30 percent, considering that the gaming receipts dropped by more than 30 percent in 2015.

Fong noted that during the sector’s five-month recovery, the year-on-year rise in casino receipts accelerated in the first few months, but the increase in December slowed to eight percent, following a two-digit percent year-on-year rise in November.

Fong said the recovery trend showed that the city’s gaming sector had experience an L-shaped one, adding the recovery would continue in this way.

Fong noted that both the mass-market and VIP segments have both shown increases during the recovery.

Fong noted that the competitiveness of the city’s tourism and gaming sectors this year would continue to be strong throughout the Asia-Pacific region, adding he did not see that any major resorts opening anywhere else in the region this year.

Fong said the opening of two Cotai resorts in the last few months of last year, along with one or two gaming resort projects expected to be completed this year, would lead to a continued rise in the mass market.

Fong also said that over the past one or two years a higher percentage of tourists stayed overnight in the city, which he said had benefitted the development of non-gaming attractions.

Fong also said that the wealth effect from the hot property market in the mainland would encourage some middle-class mainlanders to spend more money on travel, which he said would also benefit local casinos’ mass market.

Fong noted that some junket operators had left the market during the two-year adjustment period. He said that the recent recovery in the gaming sector had drawn some of them to return, adding it showed that junket operators were regaining confidence in the gaming sector’s prospects.

Fong said it was likely that all the positive factors this year would translate into a 10 percent increase in gaming revenues.

Fong was quick to add that there could be some uncertainty for the city’s gaming sector – for instance if US president-elect Donald Trump decided to launch trade wars with some developing countries, apart from possible rate-hikes by the US Fed and the continuing depreciation of the yuan.

Fong said that if all this happened, it was possible that the city’s gaming revenues might drop by five percent this year. He was quick to add that it was very unlikely all three situations would happen this year.

Fong said frequent rate rises by the Fed were unlikely this year, apart from the fact that it was unlikely Trump would make major changes to US trade policies.

Fong said the local government had made a conservative forecast for this year’s gaming revenues because it needed to adopt a cautious approach towards its fiscal management.

Fong also urged the government to invest more in public projects to increase the tourism sector’s competitiveness.

Institute for the Study of Commercial Gaming at the University of Macau (UM) Director Davis Fong Ka Chio poses during yesterday’s interview with The Macau Post Daily in his office on the public university’s Hengqin campus. Photo: Tony Wong