Edward Chen Kwan-yiu, an honorary professor of the University of Hong Kong (HKU) Business School, expects Macau to have a “relatively strong” economic recovery this year with a growth rate of around 30 percent thanks to the full resumption of travel between Macau and the mainland, which got off the ground early this year.

Chen made the remarks on February 25 during a colloquium about this year’s global economic prospects amid the ongoing international geopolitical landscape, which was jointly organised by the local Delta Asia Bank and the Macau Small and Medium Enterprises Association. Both are headed by veteran banker Stanley Au Chong Kit. The conference, which lasted three hours, was held at the bank’s headquarters in Rua do Campo.

The Statistics and Census Bureau (DSEC) announced on Friday that Macau’s gross domestic product (GDP) dropped 26.8 percent in real terms last year.

However, Chen said that this year’s GDP increment was expected to merely recover last year’s GDP decline.

According to Friday’s DSEC announcement, Macau’s GDP in real terms in 2020, 2021 and 2022 were 45.8 percent, 54.6 percent and 40 percent of the level in the pre-COVID-19 pandemic year of 2019.

According to calculations, as Macau’s 2022 GDP shrank 26.8 percent in real terms, Macau’s GDP this year would need to grow 36.6 percent to return to the 2021 level.

Chen was one of four guest speakers at the event. The other three speakers were Au, as well as Francis Tsui King-chung, an adjunct associate professor of the HKU Hong Kong Institute for the Humanities and Social Sciences (HKIHSS), and Toa Charm Ka-ieong, an associate professor of the Chinese University of Hong Kong (CUHK) Business School.

Chen, 78, a veteran economist in Hong Kong, holds a doctoral degree in Economics from the University of Oxford.

With the full resumption of Macau-mainland travel, Chen said that because of the low base level last year, Macau’s economy was expected to “rebound” significantly this year, with an estimated growth rate of around 30 percent.

Nevertheless, Chen, who headed Hong Kong’s Lingnan University between 1995 and 2007, said that he did not see “very good prospects” for neither Hong Kong’s nor Macau’s economy in the near future.

Chen said that the COVID-19 pandemic had reduced the level of manpower in both Hong Kong’s and Macau’s job markets. While Hong Kong lost highly qualified professionals over the past several years, Macau lost staff needed for the full operations of its tourism industry and various other related sectors, Chen said.

Retirement village, sanatorium park

Chen also said that so far Macau only has made “limited” achievements in its long-running drive to diversify its economy. Chen said that with the aim of supporting its economic diversification drive, Macau needed to encourage highly qualified local professionals working elsewhere to return to Macau, and train highly qualified professionals locally.

Chen also said that Macau is a place ideal for senior citizens to enjoy their retirement. As part of its drive to diversify its industries, Chen suggested that Macau develop itself into a “retirement village” as an extension of its leisure and entertainment industry. In addition, he said, Macau could set up a “sanatorium park”.

30-year global prosperity undermined in 3 years

Meanwhile, Chen also said that the world enjoyed 30 years of economic prosperity between the early 1990s and 2019, which was driven by globalisation, trade and investment liberalisation, stable labour and energy costs, China’s rapid economic growth and the accompanying formation of sophisticated supply chains globally, as well as relatively amicable geopolitics.

However, Chen said, the 30-year global economic prosperity was “undermined” by the past three years, which, in addition to the COVID-19 pandemic, was also affected by persistent high inflation, tight monetary policies by major central banks worldwide, the perceived Cold War between China and the United States, and the ongoing “hot war” between Russia and Ukraine.

Chen said that high inflation in the US in the past few years was largely due to man-made factors, instead of the COVID-19. Chen said that the US administration’s tariffs imposed on Chinese goods have been among the main factors that have contributed to the higher production costs in the US.

Consequently, Chen said, the US has been hit by cost-push inflation instead of demand-pull inflation. Chen said that the US administration has been adopting “wrong” measures to tackle the country’s high inflation, i.e., by implementing contractionary monetary policies, which was owing to “political reasons”.

Moreover, Chen also said that the United States’ currently low official unemployment rate did not reflect the country’s real unemployment because many of those who became unemployed during the earlier stages of the COVID-19 pandemic have still not returned to the labour force, as many of them are not actively looking for work.

Other guest speakers’ views

During the conference, Au said that Macau could consolidate its sustainable economic development by grasping the opportunities created by the development of the Guangdong-Hong Kong-Macau Greater Bay Area (GBA).

Au pointed out that Hengqin’s commercial system and environment have still not been fully developed, because of which, its financial development would only see achievements in the long term. Au also underlined that Macau has still not developed a sizeable securities market, including a bond market.

Charm said that small- and medium-sized enterprises (SMEs) needed to engage in digital transformation more intensively with the aim of surviving and constantly developing in the market. He said that SMEs could make good use of various tools available on the internet, such as cloud services, to achieve digital transformation at a lower cost.

Tsui said that potential black swan events that could adversely affect this year’s global economic prospects might include the US’s national debt default in the event of Congress not passing a debt ceiling increase later this year, Japan’s phasing-out of its ultra-easy monetary policy, and a resurgence of global COVID-19 outbreaks.

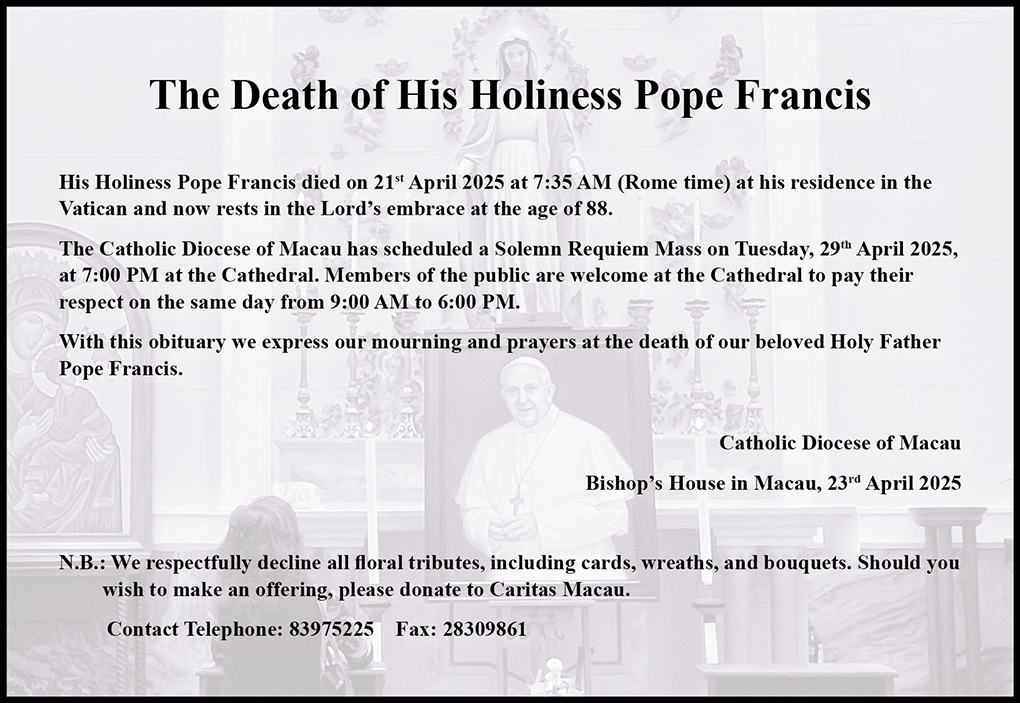

Edward Chen Kwan-yiu, an honorary professor of the University of Hong Kong (HKU) Business School, talks during a conference late last month about this year’s global economic prospects, at Delta Asia Bank’s headquarters in Rua do Campo.

– Photo: Delta Asia Financial Group